Dent stock market predictions

FRA Co-founder, Gordon T. Using exciting new research developed from years of hands-on business experience, Mr. Dent offers unprecedented and refreshingly understandable tools for seeing the key economic trends that will affect your life, your business, and your investments over the rest of your lifetime.

Dent is also a best-selling author. In his book The Great Boom Ahead, published in , Mr. Dent stood virtually alone in accurately forecasting the unanticipated boom of the s and the continued expansion into In his new book, The Demographic Cliff, he continues to educate audiences about his predictions for the next great depression, especially between and that he has been forecasting now for 20 years.

Dent received his MBA from Harvard Business School, where he was a Baker Scholar and was elected to the Century Club for leadership excellence. At Bain and Company he was a strategy consultant for Fortune companies.

He has also been the CEO of several entrepreneurial growth companies and a new venture investor. Since he has been speaking to executives and investors around the world. Other than from the aftermath of WWII, this is the first time that governments around the world have just begun frantically printing money to offset the downturns. The most important thing to understand is that central banks do not just set short term rates; they print money and buy their own bonds to set long term rates to zero.

Baby boomers are being forced to go into the stock market on higher yield assets and get crucified. Pushing long term rates so low forces people to go into stocks and other financial assets as well as allows firms on Wall Street to leverage up. This bubble we are in, which is greater than any we have been in before, is going to burst and when it does it will wipe out all the excess gains.

This financial repression is just going to destroy wealth faster than it artificially built up. It is a lifetime consumer spending cycle. We peak at age 46 and continue the trend because of automobile purchasing and especially with QE; the affluent people go to school longer which is followed by their kids and so on.

Buy and Hold This Dividend Stock Forever

Therefore peak spending for these people happens 6 years later, and it has been magnified due to QE since these are the same people who of the entire population are the ones who tend to own financial assets.

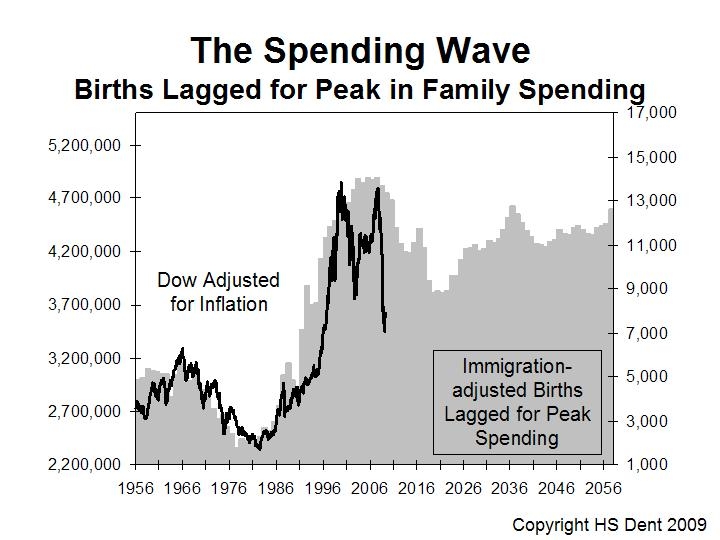

It is a graph of the birth index adjusted for immigration, and then projected forward 46 years for the peak spending of the average person. This is why since governments have been doing endless QE and stimulus just to keep the bubble going enough so that the affluent people can at least continue spending.

This demographic trend will continue to point down until which is when the next generation comes along. Authorities have been able to hold off the burst as long as they wealthy continue to spend, but they are not anymore. The productivity that was created in the s from inventions like the automobile and so on is not present today.

Today our economic progression is being backed by Facebook and watching the new viral videos. The point is that these 4 cycles have turned down only twice in the last century before this. Governments are fighting the impending crash tooth and nail and have resorted to emergency measures such as zero interest rates and in some cases even negative interest rates. From it we can see that since November , we have gone nowhere and we are right now at the bottom of the rounder top and I am confident it will not go up from here.

Europe going to be in deep trouble. Banks are failing in Italy like no tomorrow, and I predict by end of the year Italy will be the next Greece, effectively marking the end of the Euro Zone. They already have immigration problems, debt problems, and slowing growth despite endless stimulus. So what can the Fed and central banks in Europe do about that?

Once that happens it is going to send a shockwave in commodities and especially real estate, since it is the Chinese after all who are buying all the cutting edge real estate throughout the world. This is not the time to be taking risk; it is the time to be prudent. The idea is to realize that this is a once in a lifetime reset and you have to simply get out of the way.

Bubbles build on denial because everyone benefits, even the average person has a lower mortgage than car payments because of the bubble and zero interest rates.

Harry Dent's Dented Predictions - Barron's

It is because of the fact that everyone benefits that everyone goes in denial. Gold is a bubble as well. Gold went up 8x in 10 years, there are not many bubbles bigger than the gold bubble and now it is bursting. Most of the time in cycles, we either have moderate or extreme inflation, but this is the one time we have deflation and therefore I do not want to be in gold or in commodities.

We are still the best house in a bad neighborhood. China is going to be the biggest urban disaster in modern history.

Harry Dent doomsayer is bullish because of Trump - Business Insider

They have million people that are not even registered citizens working low paying jobs that are primarily focused on building infrastructure for nobody. And when this crash comes, those people are done for. When stocks crash, price earnings ratios collapse, and risk premiums go up on everything.

So if I was in stocks, I would rather be in pharmaceuticals, health and wellness etc. These are the stocks to buy when the Dow goes down to Long Publisher - LONGWave. Signup for notification of the next MACRO INSIGHTS.

Harry Dent: Stocks Will Fall % Within 3 Years | Zero Hedge

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis MATA Report. Gordon T Long is not a registered advisor and does not give investment advice.

His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments.

The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website.

Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Terms of Use Privacy Policy.

UK General Election Forecast: Theresa May to Resign, Fatal Error Was to Believe Worthless Opinion Polls! The Stock Market Crash of That Never Was But Could it Still Come to Pass? The Aftermath - 20th Jun 17 Why Walkers Crisps Pay Packet Promotion is RUBBISH! The Billion Dollar Tech Boom No One Is Talking About - 19th Jun 17 Amey Playing Cat and Mouse Game with Sheffield Residents and Tree Campaigners - 19th Jun 17 Positive Stock Market Expectations, But Will Uptrend Continue?

Grenfell Cladding Fire Disaster! Market Oracle FREE Newsletter.

Gordon T Long Archive. Only logged in users are allowed to post comments.

Any and all information provided within the web-site, is for general information purposes only and Market Oracle Ltd do not warrant the accuracy, timeliness or suitability of any information provided on this site.

We do not give investment advice and our comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to enter into a market position either stock, option, futures contract, bonds, commodity or any other financial instrument at any time.

We recommend that independent professional advice is obtained before you make any investment or trading decisions. By using this site you agree to this sites Terms of Use.

In return for that endorsement and only in the cases where you purchase directly though us may we be compensated by the producers of those products. Home Free Newsletter RSS Feed Help FAQ Terms of Use Privacy Policy Submit Articles Advertising About Us. Stock Market SPX Making New Lows - 21st Jun Your Future Wealth Depends on what You Decide to Keep and Invest in Now - 21st Jun Either Bitcoin Will Fail OR Bitcoin Is A Government Invention Meant To Enslave Strength in Gold and Silver Mining Stocks and Its Implications - 21st Jun Inflation is No Longer in Stealth Mode - 21st Jun Crude Oil Verifies Price Breakdown — Or Is It Something More?

Trump Backs ISIS As He Pushes US Onto Brink of World War III With Russia - 20th Jun Most Popular Auto Trading Tools for trading with Stock Markets - 20th Jun GDXJ Gold Stocks Massacre: The Aftermath - 20th Jun Why Walkers Crisps Pay Packet Promotion is RUBBISH!

US Bonds and Related Market Indicators - 19th Jun The Billion Dollar Tech Boom No One Is Talking About - 19th Jun Amey Playing Cat and Mouse Game with Sheffield Residents and Tree Campaigners - 19th Jun Positive Stock Market Expectations, But Will Uptrend Continue? Gold Proprietary Cycle Indicator Remains Down - 19th Jun Stock Market Higher Highs Still Likely - 18th Jun The US Government Clamps Down on Ability of Americans To Purchase Bitcoin - 18th Jun Return of the Gold Bear?

Are Sheffield's High Rise Tower Blocks Safe? Globalist Takeover Of The Internet Moves Into Overdrive - 17th Jun Crazy Charging Stocks Bull Market Random Thoughts - 17th Jun Reflation, Deflation and Gold - 17th Jun Gold Bullish on Fed Interest Rate Hike - 16th Jun Drones Upending Business Models and Reshaping Industry Landscapes - 16th Jun Grenfell Tower Cladding Fire Disaster, 4, Ticking Time Bombs, Sheffield Council Flats Panic!

Heating Oil Bottom Is In. The War On Cash Is Now Becoming The War On Cryptocurrency - 15th Jun The US Dollar Bull Case - 15th Jun The Pros and Cons of Bitcoin and Blockchain - 15th Jun The Retail Sector Downfall We Saw Coming - 15th Jun Charts That Explain Why The US Rule Oil Prices Not OPEC - 15th Jun How to Find the Best Auto Loan - 15th Jun Ultra-low Stock Market Volatility ThisTimeIsDifferent - 14th Jun DOLLAR has recently damaged GOLD and SILVER- viewed in MRI 3D charts - 14th Jun US Dollar Acceleration Phase is Dead Ahead!

Rise Gold to Recommence Work at Idaho Maryland Mine After 60 Years - 14th Jun Stock Market Tech Shakeout! The 1 Gold Stock of - 14th Jun