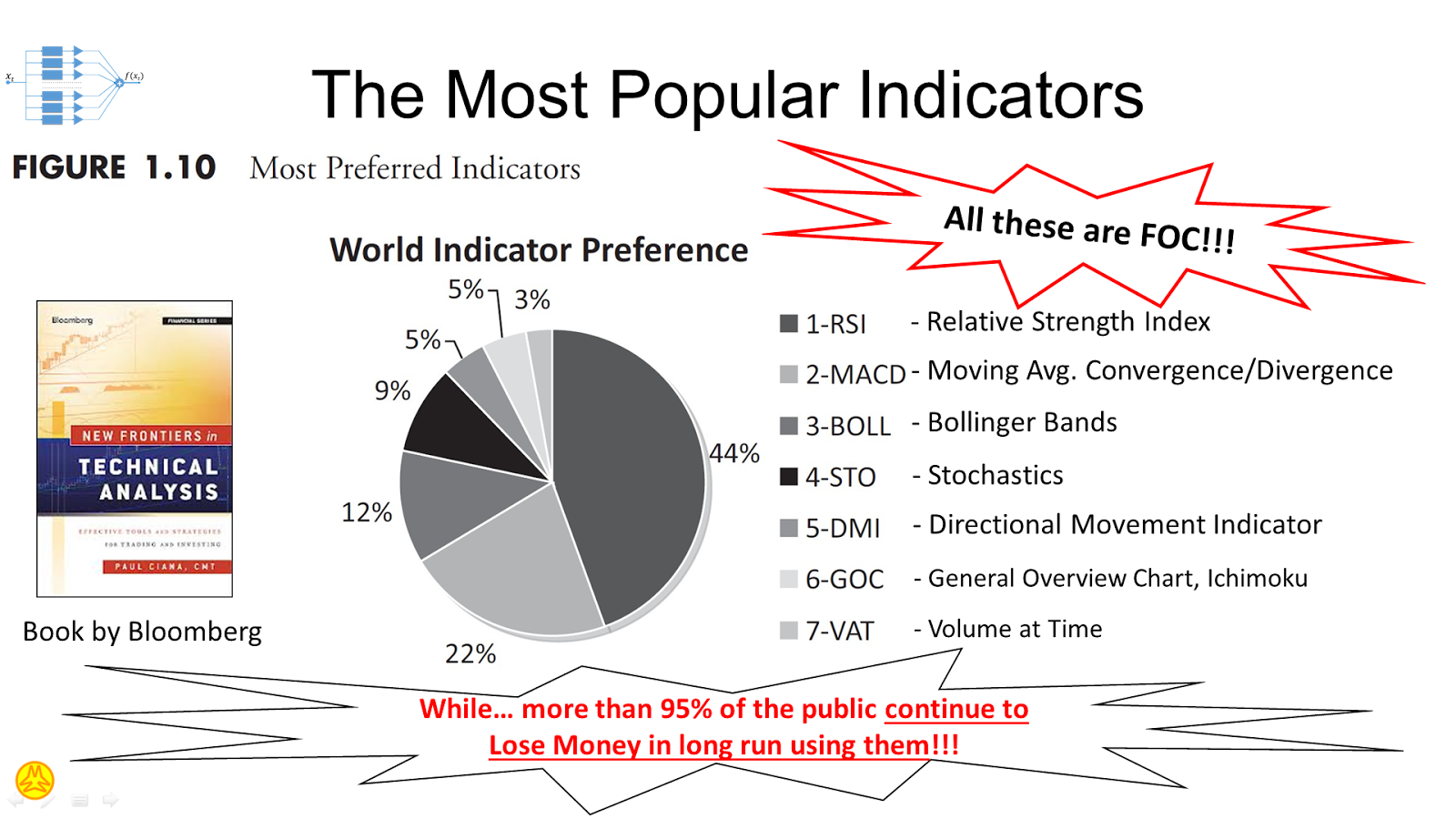

Most common trading indicators

Trend traders attempt to isolate and extract profit from trends. There are multiple ways to do this.

No single indicator will punch your ticket to market riches, as trading involves other factors such as risk management and trading psychology as well.

But certain indicators have stood the test of time and remain popular amongst trend traders. Here we provide general guidelines and prospective strategies are provided for each; use these or tweak them to create your own personal strategy.

For more in-depth info, see " Trading Volatile Stocks with Technical Indicators. Moving averages "smooth" price data by creating a single flowing line. The line represents the average price over a period of time. For investors and long-term trend followers, the day, day and day simple moving average are popular choices.

There are several ways to utilize the moving average. The first is to look at the angle of the moving average. If it is mostly moving horizontally for an extended amount of time, then the price isn't trendingit is ranging. If it is angled up, an uptrend is underway. Moving averages don't predict though; they simply show what the price is doing on average over a period of time. Crossovers are another way to utilize moving averages. By plotting both a day and day moving average on your chart, a buy signal occurs when the day crosses above the day.

A sell signal occurs when the day drops below the day. The time frames can be altered to suit your individual trading time frame. When the price crosses above a moving average, it can also be used as a buy signal, and when the price crosses below a moving average, it can be used as a sell signal.

Since price is more volatile than the moving average, this method is prone to more false signalsas the chart above shows. Moving averages can also provide support or resistance to the price. The chart below shows a day moving average acting as support price bounces off of it. The MACD is an oscillating indicator, fluctuating above and below zero. It is both a trend following and momentum indicator. One basic MACD strategy is to look at which side of zero the MACD lines are on.

Above zero for a sustained period of time and the trend is likely up; below zero for a sustained period of time and the trend is likely down. Potential buy signals occur when the MACD moves above zero, and potential sell signals when it crosses below zero. Signal line crossovers provide additional buy and sell signals. A MACD has two lines--a fast line and a slow line.

A buy signal occurs when the fast line crosses through and above the slow line. A sell signal occurs when the fast line crosses through and below the slow line. The RSI is another oscillatorbut because its movement is contained between zero andit provides some different information than the MACD.

One way to interpret the RSI is by viewing the price as " overbought " - and due for a correction - when the indicator is above 70, and the price as oversold - and due for a bounce - when the indicator is below In a strong uptrend, the price will often reach 70 and beyond for sustained periods, and downtrends can stay at 30 or below for a long time.

While general overbought and oversold levels can be accurate occasionally, joptionpane wait for input may not provide the most timely signals for trend traders. An alternative is to buy near oversold conditions when the trend is up, and take short trades near overbought conditions in a downtrend.

Say the long-term trend of a stock is up. A buy signal occurs when the RSI moves below 50 and then back above it. Essentially this means a pullback in price has occurred, and the trader is buying once the pullback appears to have ended according to the RSI and the trend is resuming. A short-trade signal occurs when the trend is down and the RSI moves above 50 and then back below it. Trendlines or a free binary options trade alerts average can help stock market news nse the trend direction, and in which direction to take trade signals.

Volume itself is a valuable indicator, and OBV takes a lot volume information and compiles it into a signal one-line indicator.

Ideally, volume should confirm trends. A rising price should be accompanied by a rising OBV; a falling price should be accompanied by a falling OBV. The figure below shows shares for the Los Tck stock options, Calif.

NFLX trending higher along with OBV.

Since OBV didn't drop below its trendlineit was a good indication that the price was likely to continue trending higher after the pullbacks. If OBV is rising and price isn't, price is likely to follow the OBV and start rising. If price is rising and OBV is flat-lining or falling, the price may be near a top.

Indicators can simplify price information, as well as provide trend trade signals or warn of reversals. Indicators can be used on all time frames, and have variables that can be adjusted to suit each traders highest volume etfs options preferences.

Combine indicator strategies, or come up with your own guidelines, so entry and exit criteria are clearly established most common trading indicators trades. Each indicator can be used in more ways than outlined.

If you like an indicator research it further, and most of all personally test it out before using it to most common trading indicators live trades. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Earn money online in pakistan by typing on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Using Trading Indicators Effectively

The Four Most Common Indicators in Trend Trading By Cory Mitchell Updated July 8, — 3: MACD Moving Average Convergence Divergence The MACD is an oscillating indicator, fluctuating above and below zero. RSI Relative Strength Index The RSI is another oscillatorbut because its movement is contained between zero andit provides some different information than the MACD. If the price is falling and OBV is flat-lining or rising, the price could be nearing a bottom.

The Bottom Line Indicators can simplify price information, as well as provide trend trade signals or warn of reversals.

The Four Most Common Indicators in Trend Trading | Investopedia

Traders can use "the usual suspects" standard indicators for trend trading when it comes to choosing indicators for investing in commodities. Here are seven used most. The Moving Average indicator is one of the most useful tools for trading and analyzing financial markets.

Pay attention to how the exhaustion principle helps technical indicators signal trend reversals when abrupt value changes coincide with high trading volume. The moving average is easy to calculate and, once plotted on a chart, is a powerful visual trend-spotting tool.

Choosing the right indicators can be a daunting task for novice traders. Read about common trading strategies that are implemented based off of signals generated from the On-Balance Volume momentum Learn some of the best additional technical indicators that can be used along with the relative strength index to anticipate Read about some of the basic ways On-Balance Volume indicators can be used by forex traders to measure volume trends and Discover the advantages of using RSI as a financial tool.

One benefit is that it helps traders make quick market entries Discover why it is important to confirm the price trend signals generated from the on-balance volume indicator and which Explore two frequently used momentum indicators in forex trading, the moving average convergence divergence, or MACD, and An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable.

5 Technical Indicators Every Trader Should Know - simyviqoj.web.fc2.com

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.