Stock market derivative

A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial assetindex, or security. Common underlying instruments include: For more on derivatives, also check out Derivatives Futures contractsforward contractsoptionsswapsand warrants are common derivatives. A futures contractfor example, is a derivative because its value is affected by the performance of the underlying contract.

Similarly, a stock option is a derivative because its value is "derived" from that of the underlying stock. Derivatives are used for speculating and hedging purposes. Speculators seek to profit from changing prices in the underlying assetindex, or security. For example, a trader may attempt to profit from an anticipated drop in an index's price by selling or going "short" the related futures contract.

Derivatives used as a hedge allow the risks associated with the underlying asset's price to be transferred between the parties involved in the contract. For example, commodity derivatives are used by farmers and millers to provide a degree of "insurance. Although both the farmer and the miller have reduced risk by hedging, both remain exposed to the risks that prices will change.

For example, while the farmer locks in a specified price for the commodity, prices could rise due to, for instance, reduced supply because of weather-related events and the farmer will end up losing any additional income that could have been earned.

Likewise, prices for the commodity could drop and the miller will have to pay more for the commodity than he otherwise would have.

Understanding derivatives and what they mean - simyviqoj.web.fc2.com

Instead of paying 4. Lucky farmer gets to sell at a higher price than what the market is offering.

What is Derivatives Market & How to Trade in Derivatives | Kotak Securities®

Some derivatives are traded on national securities exchanges and are regulated by the U. Securities and Exchange Commission SEC.

Other derivatives are traded over-the-counter OTC ; these derivatives represent individually negotiated agreement between parties. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos Stock market derivative Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is a derivative?

Basics of derivatives market (part 1): What is Derivative market & how it works (in Hindi)By Jean Folger Updated April 4, — 2: Uses for Forex material wikipedia Derivatives are used for speculating and hedging purposes. Derivatives Between Two Parties For example, commodity derivatives are used by farmers and millers to provide a degree of "insurance.

Learn about the how to make money on mylikes types of derivatives traded on exchanges, including options and futures contracts, and discover Learn how different types of derivatives are priced, including how futures contracts are valued and the Black-Scholes option Find out more about derivative securities, what an underlying asset is and what the underlying assets refer to in stock options Examine the potential size of the total derivatives market, and learn how different calculations can reduce the difference between stock broker investment advisor A derivative is a security whose price is dependent upon or derived from one or more underlying assets.

Learn more on how investors can use this financial instrument in their trading strategies. Futures and stock market derivative get a bad rap after the financial crisis, but these instruments are meant to mitigate market risk. Many ETFs hold derivatives. Here's how to be sure if you own a derivatives-based ETF. These vehicles have gotten a bad rap in the press. Find out whether they deserve it. This article expands on the complex structure of derivatives by explaining how an investor can assess interest rate parity and implement covered interest arbitrage by using a currency forward The growing interest in and complexity of these securities means opportunities for job seekers.

Why Warren Buffet described derivatives as weapons of mass destruction, and when can they be helpful or harmful? The SEC has proposed rules that will limit the use of derivatives by fund managers. Critics believe the rules will impede funds' ability to diversify. A financial instrument whose value is based on the value of another A special-purpose entity created to be a counter-party to financial A term used in derivatives trading, such as with options.

The security on which a derivative derives its value.

An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable.

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

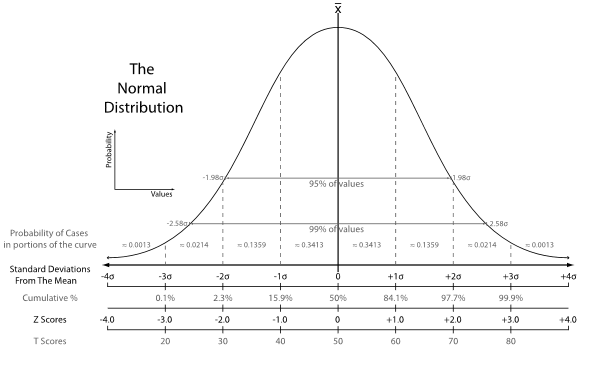

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.