Emerging market bond etf local currency

This article is part of a regular series of thought leadership pieces from some of the more influential ETF strategists in the money management industry. Today's article features Clayton Fresk, CFA, portfolio management analyst at Georgia-based Stadion Money Management.

The talk of higher interest rates here in the U. This, combined with the still-anemic interest-rate environment in which we currently reside, has investors looking for alternate sources of income. There has been much talk about stepping down in quality here in the U. Another route that has been discussed is diversifying outside of U. While developed-market exposure is an option, in the following, I will look at various emerging market bond exposures available in ETF form.

The most popular way ETF investors currently access emerging market bonds solely based on assets under management is via dollar-denominated sovereign debt. The three most prevalent names in that space with performance through Nov. While not exactly the same, the iShares J.

Morgan USD Emerging Markets Bond EMB B and the Vanguard Emerging Markets Government Bond VWOB B are more similar to one another than the PowerShares Emerging Markets Sovereign Debt PCY B One differential is that VWOB follows an issuer-capped index, so it will have lower exposure to the largest EM issuers China, Russia, Mexico and Brazil as compared with EMB.

However, PCY differs from the other two in that it uses a balanced index. The fund currently has equal-weight exposure to 28 different EM countries which currently excludes China.

Using the indexes for PCY DBLQBLTR and EMB JPEICORE , here is a comparison of return and risk since March As you can see, the index for PCY has a greater return and the fund currently has a slightly higher yield than EMB and VWOB , with the trade-off being a bit higher risk as measured by both standard deviation and maximum drawdown.

Guide to Local Currency Emerging Market Bond ETFs - March 3, - simyviqoj.web.fc2.com

For some investors, the appeal of investing outside of the U. While the aforementioned ETFs do not have the currency effect, as they are USD-denominated issues, there is a plethora of local EM bond ETFs available. Additionally, investing in entities that can issue in local currency rather than in dollar-denominated bonds opens an investor up to a different set of issuer qualities.

Here is a list of local EM bond ETFs, again, with performance through Nov. As illustrated by the YTD performance column, there is not a significant amount of dispersion between these names. Here is a breakdown of allocation percentage by country:. While, for the most part, the country exposures do not vary, there are a few exceptions.

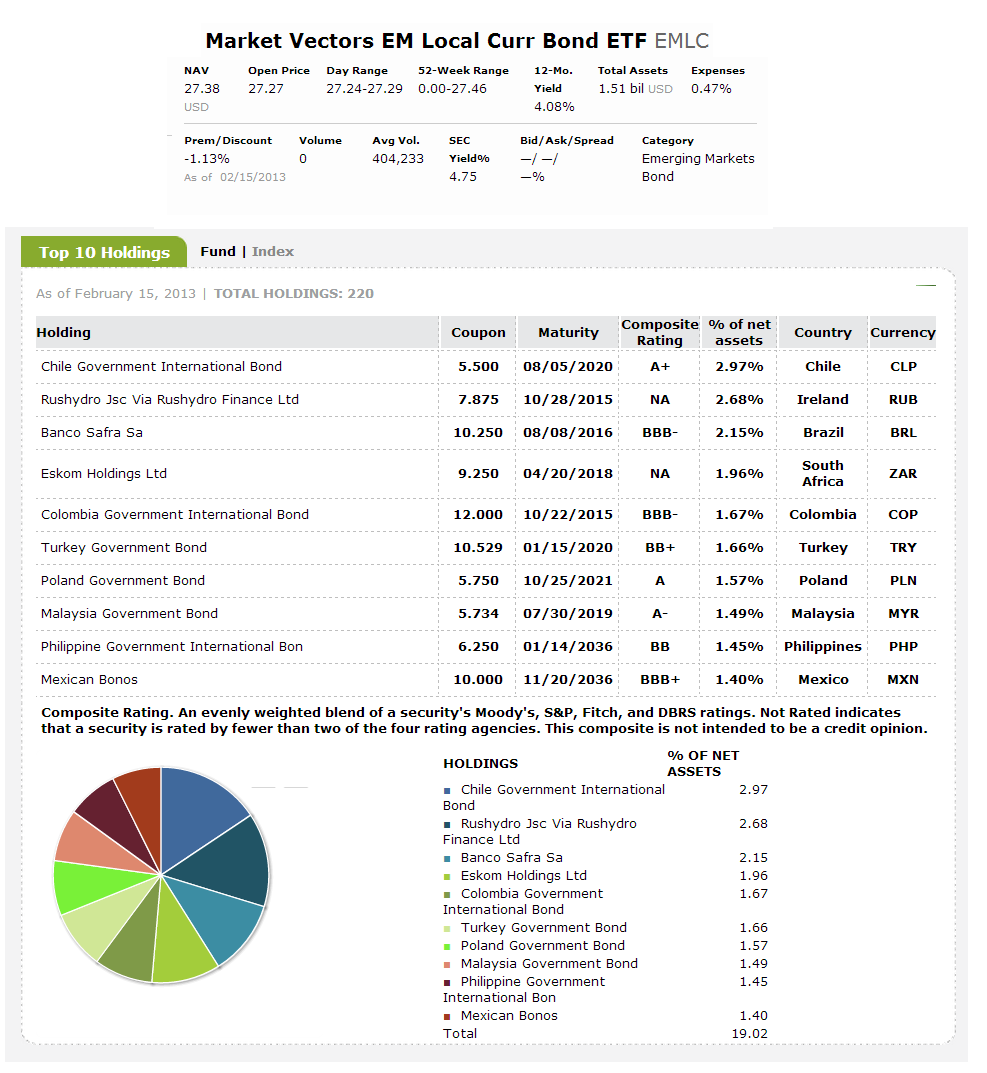

The one that sticks out is South Korea. Due to differing index methodologies in emerging versus developed classifications, the iShares Emerging Markets Local Currency Bond LEMB C has more than 20 percent exposure, while the Market Vectors J. Morgan EM Local Currency Bond EMLC C and the First Trust Emerging Markets Local Currency Bond FEMB F have no exposure. As I mentioned above, a major difference in these names is the currency exposure as compared to the dollar-denominated ETFs.

Additionally, the issuer exposure is also different. As such, if there were a currency-hedged local bond ETF, it would not have the same characteristics as a USD-denominated ETF. Using the index for the SPDR Barclays Emerging Markets Local Bond EBND D as an example, here is the local versus hedged YTD performance as compared to the same USD-denominated EMB index used above:.

Stepping back into the dollar-denominated area, another option for investors is corporate debt versus sovereign debt. ETFs available to invest in corporate debt are:. To illustrate the corporate versus sovereign decision, here are some side-by-side comparisons of the different ETFs versus EMB: While the yields are somewhat similar, there is a bit of a trade-off of accepting more spread risk in corporates while also getting a bit lower duration.

Additionally, the top country exposure is more concentrated similar to local currency sovereigns. When looking to emerging market bonds as an alternative to U.

What Are Local Currency Emerging Market Bonds?

An investor just needs to decide what type of issuer exposure they are comfortable with, whether it is sovereign or corporate, and dollar versus local denominated. The above constitutes the personal, professional opinion of Clayton Fresk, CFA, and does not reflect the views of Stadion Money Management LLC. References to specific securities or market indexes are not intended as specific investment advice.

Founded in , Stadion Money Management is a privately owned money management firm based near Athens, Georgia. View the discussion thread. Legendary investor discusses why he sees big economic downturn approaching and how investors can protect themselves. Skip to main content. Choices For Emerging Market Bond ETFs November 17, USD-Denominated Sovereign The most popular way ETF investors currently access emerging market bonds solely based on assets under management is via dollar-denominated sovereign debt.

Local Currency Sovereign For some investors, the appeal of investing outside of the U. Here is a breakdown of allocation percentage by country: Using the index for the SPDR Barclays Emerging Markets Local Bond EBND D as an example, here is the local versus hedged YTD performance as compared to the same USD-denominated EMB index used above: Dollar-Denominated Corporates Stepping back into the dollar-denominated area, another option for investors is corporate debt versus sovereign debt.

ETFs available to invest in corporate debt are: Conclusion When looking to emerging market bonds as an alternative to U. Fixed Income Emerging Markets ETF Issuers. Find your next ETF Asset Class: All Asset Classes Alternatives Asset Allocation Commodities Currency Equity Fixed Income. All Regions Asia-Pacific Developed Markets Emerging Markets Europe Frontier Markets Global Global Ex-U. Greece Hong Kong India Indonesia Ireland Israel Italy Japan Latin America Malaysia Mexico Netherlands New York New Zealand Nigeria Nordic North America Norway Pakistan Peru Philippines Poland Portugal Qatar Russia Saudi Arabia Singapore South Africa South Korea Southeast Asia Spain Sweden Switzerland Taiwan Thailand Turkey U.

United Arab Emirates Vietnam. More by Clayton Fresk Clayton Fresk. Alternative Strategies In ETFs Vs Mutual Funds Non-US Fixed Income ETFs: Next Domino To Fall Alternatives To Broad High Yield Bond ETFs These ETFs Are Beating The Market. These funds have gathered significant assets so far this year.

Features and News June 21, Active Management Alpha-Seeking Fixed Income. More Evidence Against Active. Factors To Focus On Now. First Trust Has Busy Day. Firm rolls out seven funds in one trading day.

Daily ETF Watch June 21, Dividend Smart-Beta ETFs Volatility. Related ETFs 1 MONTH CHANGE. Related Articles Monday Hot Reads: Measuring Smart Beta ETF Performance.

Not Much Vanilla In May Launches. Jim Rogers Bracing For Crash. Features and News June 20, Commodities Oil Gold. Related Articles 15 ETFs With The Most Liquid Options. Worst Performing ETFs Of Guggenheim Launches Multifactor Fund. Daily ETF Watch June 20, Equity U.

Related Articles 4 Active ETFs Gaining Serious Ground.

MSCI To Include China A-Shares In Key Index. Investors took profits on U.

Bond ETF List, Screener, Guide & News | simyviqoj.web.fc2.com

Daily ETF Flows June 20, Equity Fixed Income Bond. An annual study from Dimensional Fund Advisors offers more evidence against active management. Index Investor Corner June 19, Active Management Alpha-Seeking Equity. Pacer Adds 2 'Cash Cow' Funds.

New ETFs target foreign and small-cap firms with high free-cash-flow yields. Daily ETF Watch June 19, Smart-Beta ETFs Launch Equity. Related Articles ETF Watch: Equal Weighting Not So Magical.

Understanding the fund: Aberdeen Emerging Markets Local Currency Bond FundFirst Trust Fund Gets Makeover. AUM for the world's largest ETF fell on Friday, June Daily ETF Flows June 19, Equity Fixed Income Bond.

Persistent Returns Remain Elusive. Funds that outperform rarely manage to repeat their success. Index Investor Corner June 16, Index Investing Active Management Alpha-Seeking.

Related Articles Tuesday Hot Reads: How A Small Foundation Trounced The Big Guys. ETFs Are Crushing Active Managers. Founder of DoubleLine shares his latest thoughts on the financial markets. Features and News June 16, Equity Fixed Income Bond. Active Management , BlackRock , Bond , Broad Market , Broad Maturities , Corporate , Emerging Markets , Emerging Markets ETFs , First Trust , Fixed Income , Fixed Income ETFs , Global Bond ETFs , iShares , Invesco PowerShares , PowerShares , SPDR , Smart-Beta ETFs , Sovereign , State Street Global Advisors , VanEck , Vanguard , WisdomTree.