Seasonal investing stock market

Seasonality is basically a technical signal generator with an essentially fundamental background.

It can be characterized as a blend of both price and calendar elements. In a statistical sense, the calendar aspect delivers added benefit because as an external factor it is independent of standard indicators. It is similar with intermarket analysis or fundamental analysis.

BlueChipPennyStocks - The number one trusted financial newsletter site

This added benefit is seasonality's main advantage it does not correlate with other indicators. External signal generators do not have a virtual automatic loss-limiting function with individual signals, as is the case with trend following methods, which means for example that stop loss orders should be used. The disadvantages of seasonality include the fact that individual years can vary, that seasonality itself can change and that random events e. It must be kept in mind that seasonality as such does not exist in one market; rather only individual seasonal patterns exist.

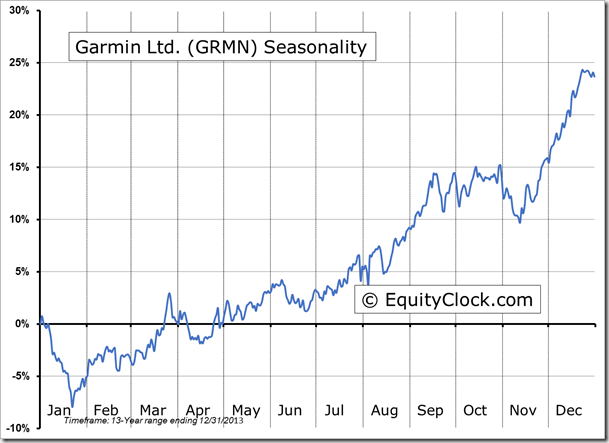

Because of its calendared nature, seasonality is really an intermediate-term signal generator. Nevertheless, it can also be used for short-term trading because the primary trend also influences the profitability of short term signals this can for instance be utilized with the leverage-trading strategy. Long-term oriented investors can also utilize seasonality, namely for fine tuning entry for example by shifting the planned buying of a stock from August to the more favorable November time frame.

Seasonal Investing – Stock Seasonal Trend | Stock Seasonal Strength

Home Spot Futures Volatility Cycles Intraday Weather Indices Search. Start FAQ Info Strategies Seasonality. Metals Energy Farm Products Currencies Interest.

Metals Energy Farm Products Currencies Interest Indices. Metals Currencies Interest Indices. Temperature Precipitation Snow Depth.

DivHutSeasonal Stock Market Investing - DivHut

USA Countries Sectors Long Term. E-Mail of the receipient Your message: Hello, I'd like to recommend this web page to you: Send Close this form without sending [X].

Single pattern Characteristics of seasonality Seasonality is basically a technical signal generator with an essentially fundamental background. In seasonally unfavorable periods, investments are waived. This leads to fewer losses and a reduction in drawdowns. In the process the profit side is also reenforced. During the seasonally weak months of August through October equity investments are shunned.

The following diagram clearly shows that in this way, during all market phases, each with varying points of entry, a significant out-performance was attained through the end of Thus, even this simple approach increased profits. This is even more remarkable considering that the strategy is defensive; after all, over a period of three months you are not even in the volatile equity market.

DAX - Best-Seasons-Strategy Sources: