Mean reversion strategy rsi

It aims to make quick trades that last only for a few days. The system was published by Larry Connors and Cesar Alvarez in their book High Probability ETF Trading: In that book, they suggest that adjusting the time period for the RSI indicator from its standard of 14 down to 4 will dramatically increase the edge of that indicator. The system uses a day simple moving average SMA to determine the long term trend.

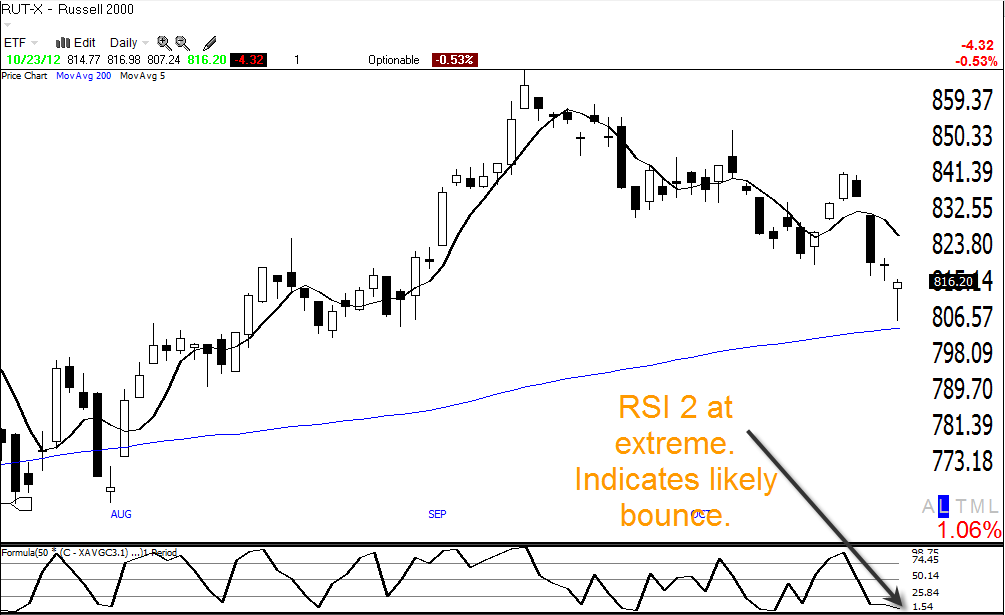

Then, it signals a long position anytime a market in an uptrend has its RSI indicator drop below It exits that position when the RSI crosses above For a downtrending market, the system enters a short position when the RSI rises above 75 and exits that position when the RSI drops below In their book, Connors and Alvarez backtested this strategy across 20 ETFs from the inception of each ETF through the end of There were a total of trade signals on the long side that averaged a return of 1.

The trades averaged a length of 6. On the short side, trades were signaled.

Those trades averaged a profit of 1. Wondering if publishing the system would skew its performance, blogger Sanz Prophet tested the system from the beginning of through September 5, trading both long and short signals. His results showed that the system logged an annual return of 7. He also noted that the system produced winners on The results for all three systems are very similar. They all accumulate small profits through lots of quick trades, and they have a very high win rate on those trades.

The issue with this system is the same as every other mean reversion system, it leave you open to taking a crippling loss.

In that respect, these mean reversion systems are actually quite similar to martingale systems. They almost always produce a profit, except when a black swan shows up.

Trading Podcast full of Forex, Stocks & Futures Technical Analysis Ideas - 52 Traders Podcast

The RSI is eventually going to come back to the middle where you exit the trade, and usually it will do so rather quickly. For both of the previous mean reversion systems, I suggested that I would be curious to see how adding a stop-loss component would impact the results. The same holds true for this system.

I have also discussed trading a mean reversion system as part of a package that trades multiple systems. If you were to break down a number of different systems and then determine a way to trade each of them when they were most likely to be successful, perhaps you could gain an edge.

7 Free Trading Systems and Their Returns From The Last 13 Years - ASX Market Watch

Again, this would require extensive testing. Another idea that I would be interested to test would be putting a time limit on each trade. It would be interesting to explore how many of the losing trades lasted longer than the average trade length.

Perhaps we could find a length that could have taken smaller losses before they became larger losses. The current chart of the SPY provides a great example for this system. The SPY is well above its day SMA, so it is in an uptrend.

George Pruitt - Backtesting with [Trade Station,Python,AmiBroker, Excel]

Its RSI indicator dipped down to 25 two times in the month of June. Each of those trades would have been exited at a profit only a few days later as the RSI jumped back above 55 both times. Keep in mind that this is just an example over an incredibly small sample size. The system is certainly not guaranteed to perform like this every time.