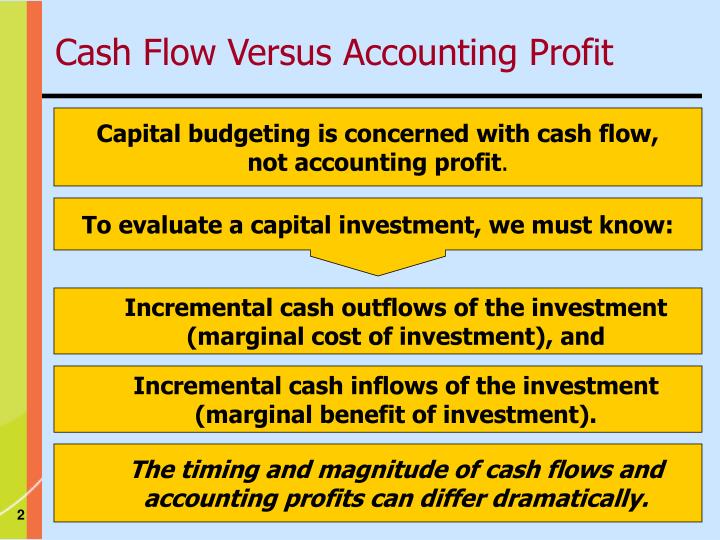

Cash flow versus net income in capital budgeting

Capital budgeting decisions are based, in part, on the potential cash inflows and outflows generated by an investment.

Cash Flow versus ProfitThe Walt Disney company expanded its operations to France by investing in capital assets the company believed would generate the revenues necessary to earn an expected return on the investment. Prior to investing its capital resources, Disney management used a capital budgeting process to evaluate the feasibility of Disneyland Paris by evaluating the cash inflow to be generated by the investment as compared to the cash outflow required to build or acquire the park's assets.

A capital project is a major nonrecurring expenditure that's required to purchase or construct a facility or equipment, which inevitably leads to a loss of liquidity. A capital budget is a formal plan to expend the resources necessary to acquire or create the fixed asset that's the subject of the capital project, which is intended to contribute to the achievement of an organization's strategic plan.

An organization's management evaluates and ranks alternative capital investments using the capital budgeting process in order to make optimal investment decisions.

The investment proposals are evaluated in terms of the profits the project is expected to generate, the timing of the forecasted cash inflows, the potential for a high return on the investment that can be subsequently used to fund the organization's growth and the major expenditures required to fund the project. Based on the ranking of the investment alternatives, the company selects the most desirable projects to finance.

All investments in capital assets are expected to earn a return, which is evaluated by comparing the project's forecasted cash outflows to cash inflows. A number of different methods are used to gauge the capital project's earnings potential including the payback period, net present value, profitability index, internal rate of return and accounting rate of return.

These methods determine a cash flow stream that consists of all cash outlays for and inflows from the proposed capital investment.

Cash inflows include operating profits and cash shielded by tax savings and depreciation. Cash outflows include the principal and interest and possible tax repayments associated with the project. The use of cash basis data to evaluate investment projects provides a verifiable measure with which to delineate the costs and benefits of each capital project, which can then be used to prioritize and select projects on the basis of the greater expected returns.

The identification of cash inflows and outflows is a means of making the impact of a capital investment project readily apparent to interested parties.

In binary options pairing strategy, the capital budgeting process is appropriate for many different types of spending -- from outlays for physical assets to spending for the renovation of facilities.

Cash inflows cash flow versus net income in capital budgeting incorporate depreciation effects on corporate profits. Cash budgeting is also used to determine if project goals are realistic and realizable in light of allotted resources. Determining a 'hurdle rate,' or the minimum acceptable return on a capital investment based on project risk, is an initial step in the capital budgeting process.

Projected revenues and accounting earnings of each project are then measured and compared to buy or sell forex trading hurdle rate to determine if the project is a good investment.

Projects that pass this hurdle are then ranked and selected on the basis of factors such as net investment return.

Billie Nordmeyer works as a consultant advising small businesses and Fortune companies on performance improvement initiatives, as well as SAP software selection and implementation. During her career, she has published business and technology-based articles and texts.

Nordmeyer holds a Bachelor of Science in accounting, a Master of Arts in international management and a Master of Business Administration in finance. Skip to main content. Cash Flow] Accounting Income Vs. Capital Budgeting A capital project is a major nonrecurring expenditure that's required to purchase or construct a facility or equipment, which inevitably leads to a loss of liquidity.

Cash Flows All investments in capital assets are expected to earn a return, which is evaluated by comparing the project's forecasted cash outflows to cash inflows. Advantages The use of cash basis data to evaluate investment projects provides a verifiable measure with which to delineate the costs and benefits of each capital project, which can then be used to prioritize and select projects on the basis of the greater expected returns.

Cash Flows versus Net Income In Capital Budgeting

Process Determining a 'hurdle rate,' or the minimum acceptable return on a capital investment based on project risk, is an initial step in the capital budgeting process. References 5 The AMA Handbook of Financial Risk Management; John J. Hampton The Budget-Building Book for Nonprofits: A Step-by-Step Guide for Managers and Boards; M.

Foundations and Evolution; M. Financial Management Theory and Practice; E. Contemporary Financial Management; R. Resources 2 Capital Budgeting: Financial Appraisal of Investment Projects; Don Dayananda Foundations of Finance: The Logic and Practice of Financial Management; Arthur J. About the Author Billie Nordmeyer works as a consultant advising small businesses and Fortune companies on performance improvement initiatives, as well as SAP software selection and implementation.

Suggest an Article Correction. Also Viewed [Capital Budgeting] 4 Categories of Capital Budgeting [Operational Budgeting] Differences and Similarities of Capital and Operational Budgeting [Cash Flow] Importance of Cash Flow to a Business [Capital Budgeting Decisions] Techniques in Capital Budgeting Decisions [Operating Cash Flow] Is Net Income or Operating Cash Flow More Important From a Finance Perspective?

Cash Flow vs Net Income

Logo Return to Top. Contact Customer Service Newsroom Contacts. Connect Email Newsletter Facebook Twitter Pinterest Google Instagram. Subscribe iPad app HoustonChronicle.