Hewlett packard stock buyback

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience. By Karen Brettell , David Gaffen and David Rohde. Combined stock repurchases by U. The three CEOs, over the span of a dozen years, followed a strategy that has become the norm for many big companies during the past two decades: All those buybacks put lots of money in the hands of shareholders.

It has been slow to make a mark in more profitable software and services businesses. In its core businesses, revenue and margins have been contracting. But six years into the current expansion, a growing chorus of critics argues that the ability of HP and companies like it to respond to those shifts is being hindered by billions of dollars in buybacks.

These financial maneuvers, they argue, cannibalize innovation, slow growth, worsen income inequality and harm U. CEO Meg Whitman has just overseen one of the largest corporate breakups ever attempted, creating one company for the PC and printer business, called HP Inc, and one for the corporate hardware and services business, called HP Enterprise. A Reuters analysis shows that many companies are barreling down the same road, spending on share repurchases at a far faster pace than they are investing in long-term growth through research and development and other forms of capital spending.

Almost 60 percent of the 3, publicly traded non-financial U. The analysis shows that spending on buybacks and dividends has surged relative to investment in the business.

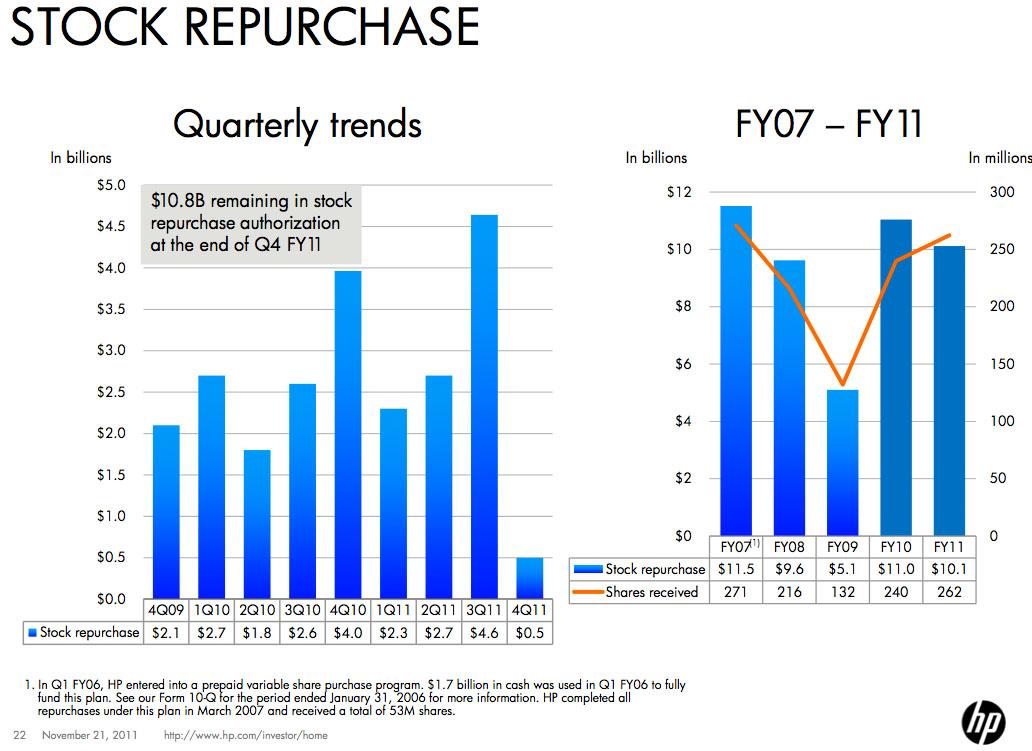

HP expands stock buyback program by $10 billion | Reuters

Among the 1, companies that have repurchased their shares since , buybacks and dividends amounted to percent of their capital spending, compared with 60 percent in and 38 percent in It had been over 60 percent during the s. The phenomenon is the result of several converging forces: It now pervades the thinking in the executive suites of some of the most legendary U.

The company had 53, full-time employees last year, down from 60, in In theory, buybacks add another way, on top of dividends, of sharing profits with shareholders. By decreasing the number of shares outstanding, they also increase earnings per share, even when total net income is flat. But if those buybacks come at the expense of innovation, short-term gains in shareholder wealth could harm long-term competitiveness.

Why America Needs a Manufacturing Renaissance. If a company in Germany, India or Brazil has something to do with the money, it will flow there, as it should, and create growth and activity there, not in the United States. Even national security could be threatened as a shrinking defense budget has made it more difficult for contractors to justify research spending.

David Melcher, chief executive of the Aerospace Industries Association, said companies have turned to buybacks because of a dearth of new weapons programs and under pressure from Wall Street. Among the largest U.

In recent months, as the election campaigns have gathered momentum, concern about the long-term effects of the buyback craze has crept into public discourse and caught the attention of politicians. Democrat Senators Elizabeth Warren and Tammy Baldwin have called on the Securities and Exchange Commission to investigate buybacks as a potential form of market manipulation.

In July, she proposed increasing taxes on short-term investments and more rigorous disclosure of share repurchases and executive compensation. These moves, she said, will foster longer-term investment, innovation and higher pay for workers.

Fiorina, now a Republican presidential contender running on her record as a corporate executive, declined multiple requests for comment. Hurd, now a co-chief executive at Oracle Corp, told Reuters that repurchases were an appropriate use of capital.

Until , companies were largely prohibited from buying their own shares.

Corporate America's buyback binge feeds investors, starves innovation

Weinberg Center for Corporate Governance at the University of Delaware. That goal has come to the fore in some high-profile cases of late as activist investors have demanded that executives share the wealth — or risk being unseated.

Even so, CEO Ellen Kullman stepped down in October after sales slowed and the stock slid. Managers ignore shareholder demands at their own risk, especially when the share price is under pressure. It has been spending a lot more on buybacks. For decades, the computer hardware, software and services company has linked executive pay in part to earnings per share, a metric that can be manipulated by share repurchases. The company says in regulatory filings that it adjusts for the impact of buybacks on EPS when determining pay targets.

IBM has been among the most explicit in its pursuit of higher per-share earnings through financial engineering. It would do so, under the plan, through equal emphasis on improved margins, acquisitions, revenue growth, and share repurchases. It easily met its expectations. This time, more than a third of that increase was expected to come from buybacks. For a while, the plan worked. Revenue has declined for the past three years.

Earnings have fallen for the past two. To rein in costs, IBM has cut jobs. It now employs 55, fewer workers than it did in He said that the company continues to grow, and that its buybacks have not affected research, development and innovation efforts.

Share repurchases have helped the stock market climb to records from the depths of the financial crisis. As a result, shareholders and corporate executives whose pay is linked to share prices are feeling a lot wealthier. That wealth, some economists argue, has come at the expense of workers by cutting into the capital spending that supports long-term growth — and jobs.

Further, because most most U. Many of the transformative breakthroughs of the past century — light bulbs, lasers, computers, aviation, and aerospace technologies — were based on innovations coming out of the labs of companies that could afford rich funding, like IBM, Apple, Xerox Corp and HP.

Some say a technological shift at companies like HP and IBM away from traditional manufacturing, which requires large investments in buildings and equipment, and toward data-based products is also changing the calculation of how much investment is needed in innovation. Operating divisions were given broad autonomy to develop their businesses.

Employees were encouraged to think creatively in a nurturing environment. When Fiorina arrived in , she upended that, implementing companywide layoffs, shifting jobs overseas and centralizing control. He said that changes she implemented were needed because the company had become sluggish at innovation.

The number of HP-registered patents rose from 17, in to 30, when she left in , according to regulatory filings.

Hewlett-Packard (HPQ) Stock Climbs on $3 Billion 'Enterprise' Buyback Plan - TheStreet

Even so, all of those new patents failed to yield any enduringly successful innovations. Uneven earnings and concern about the Compaq acquisition whipsawed the share price during her tenure, helping lead to her ouster in Market share in each division grew. But in the PC and printer divisions, researchers said, new limits on spending disrupted project timelines.

Engineers at HP who had previously created prototypes at U. Travel to these regions was on occasion delayed due to spending pressures. The changes he implemented led to sparkling results: From to , net income rose percent on a much smaller 45 percent increase in revenue. Thanks to hefty stock buybacks, earnings per share did even better, increasing percent. Roughly 20 to 30 percent of annual repurchases offset dilution from employee stock-purchase plans.

Because he nearly always met per-share earnings and other targets, his pay mostly rose, too. Investors were impressed by the turnaround.

Hewlett Packard Stock Buybacks (TTM) (HPE)

Operating margins, which had dropped below 5 percent under Fiorina, rose as high as 9 percent under Hurd, and the share price soared percent. A year later — after Apotheker left — HP said an investigation had uncovered accounting fraud at Autonomy before the purchase.

Post breakup, her immediate challenge is to build the higher-margin HP Enterprise. Both companies will continue with generous buyback programs. HP Enterprise said in September that it expects to give shareholders at least 50 percent of free cash flow next year through buybacks and dividends. HP Inc said it will give back 75 percent. Toggle navigation The Cannibalized Company. Part 1 More in this series. As stock buybacks reach historic levels, signs that corporate America is undermining itself.

By Karen Brettell , David Gaffen and David Rohde Filed Nov.

Matthew Weber Edited by John Blanton. Other Reuters investigations and long-form narratives.